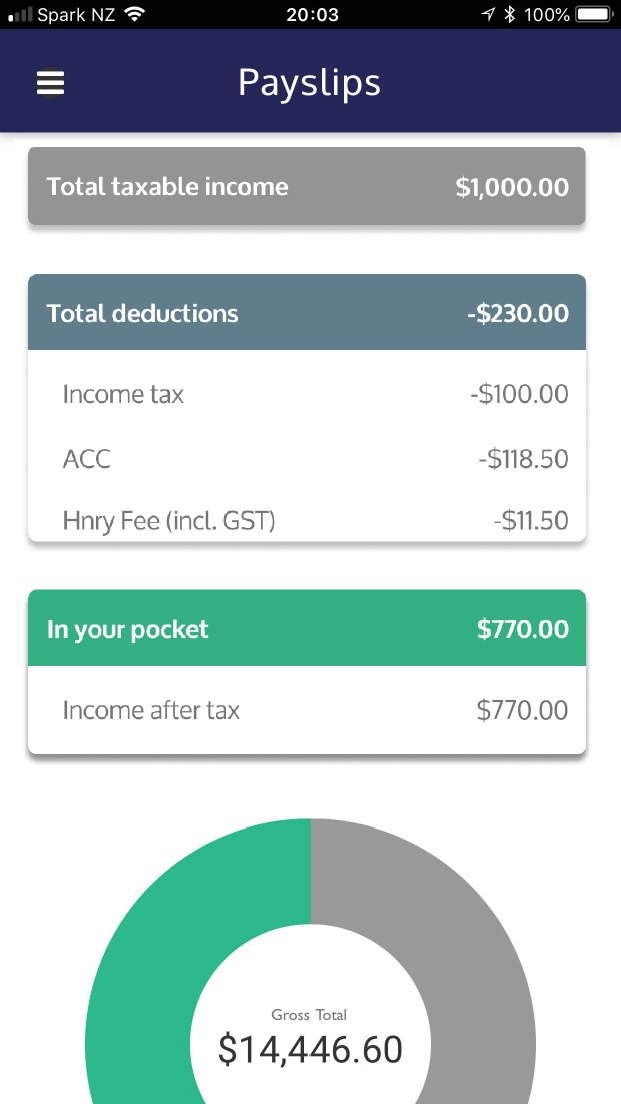

1. Automatic tax calculations and payments

Whenever you get paid into your Hnry Bank Account, we will instantly calculate and pay your:

- Income tax

- GST

- Medicare

- Student loan

2. Full access to the Hnry app

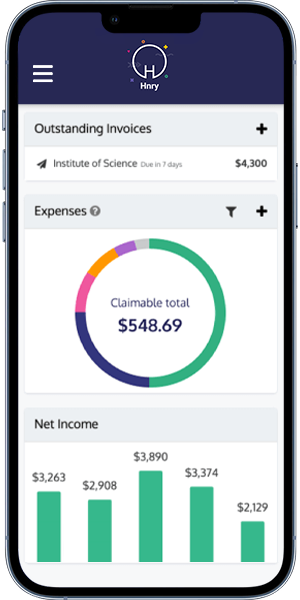

With the Hnry app, you can:

- Send unlimited invoices to your clients (we’ll even chase your unpaid invoices)

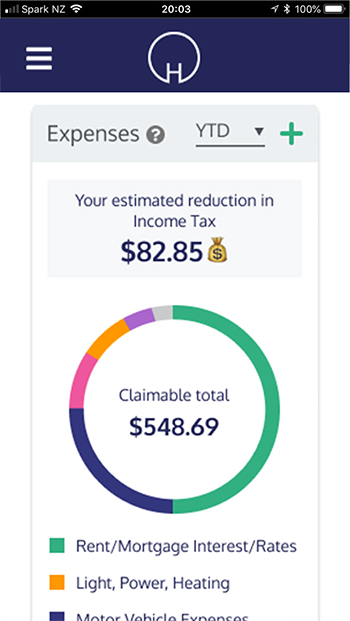

- Raise business expenses (just snap a photo and enter a few details)

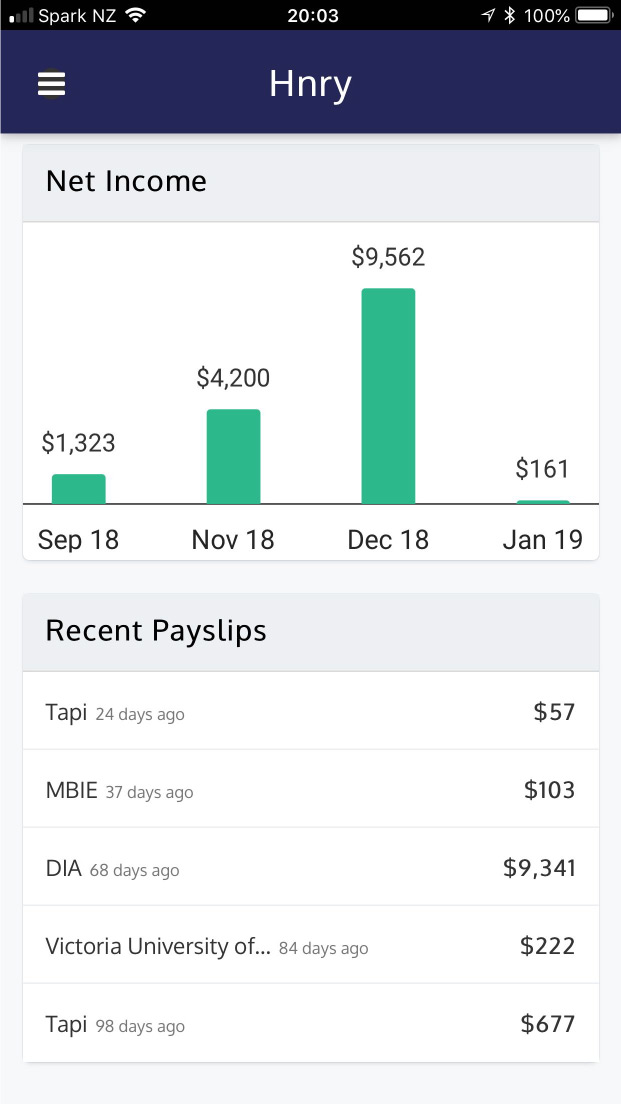

- Get insights to optimise your business’s finances

3. We become your accountant

Our team of (real human) accountants will:

- Lodge your income tax and BAS returns whenever they’re due

- Review your expenses whenever you raise them, so you get tax relief as you go

- Give personalised answers to your gnarliest tax questions

It’s easy (and free) to get started

No setup costs. No need to wait for the end of a tax year.

You can be up and running with Hnry in minutes - and never think about tax again!

Join Now

All your tax obligations - sorted!

" Hnry also lodges my income tax and BAS returns for me…I’ve got complete confidence that all my tax affairs are sorted - so I can focus on doing what I love. "

Tabitha Arthur

Freelance Photographer

More than just taxes

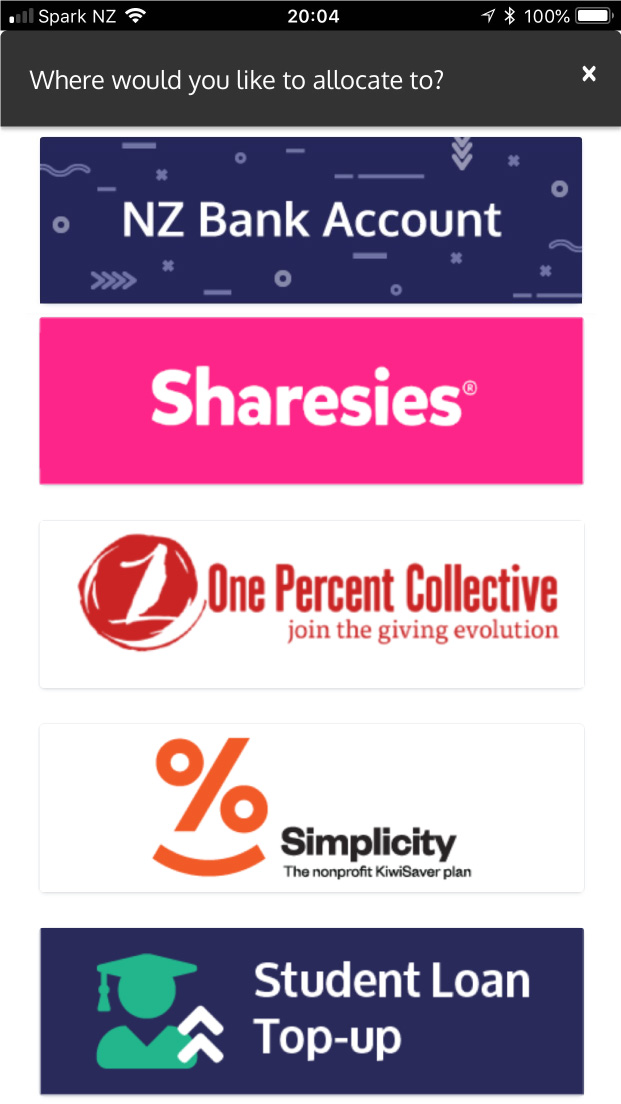

With Hnry, we don’t just pay and file all your taxes. You also get access to our online platform, packed with features that make it simple to be a contractor or freelancer

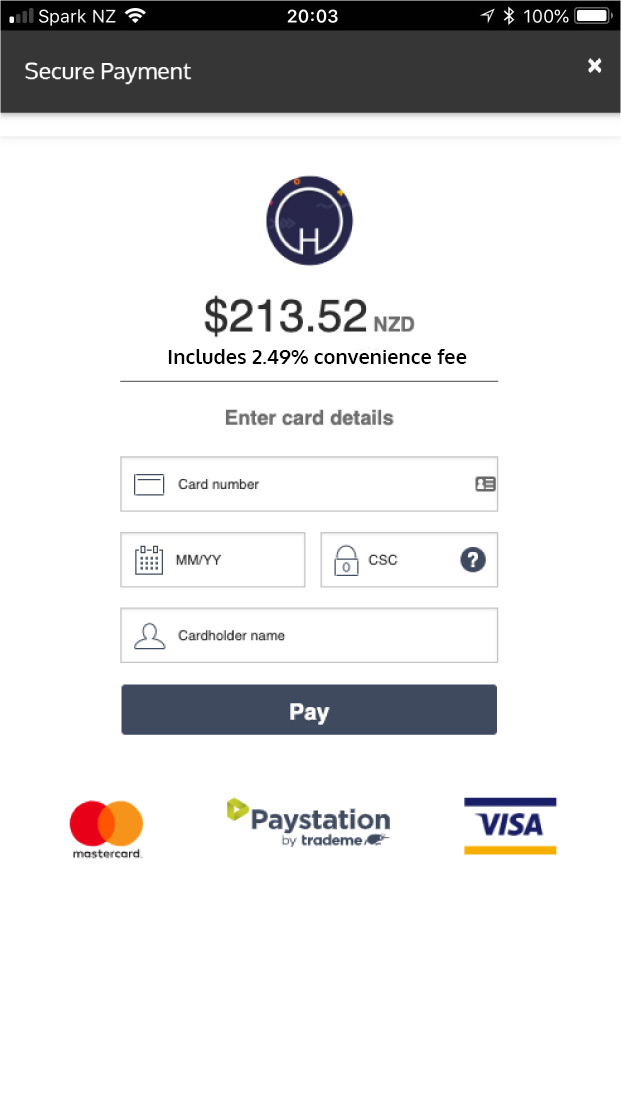

Only pay when you’re earning

Here are 5 things you need to know about Hnry’s simple, pay-as-you-go pricing:

- You pay just $1+ GST from every $100 in self-employed income you earn

- Your fees get you UNLIMITED use of the entire Hnry service and our expert accounting team

- You only pay fees when your clients pay into your Hnry Bank Account

- For anyone earning over $150,000 in a financial year, Hnry’s 1% fee is capped at $1,500

- We automatically claim your Hnry fees for you as a business expense!

Minimum $0.50 fee per transaction.