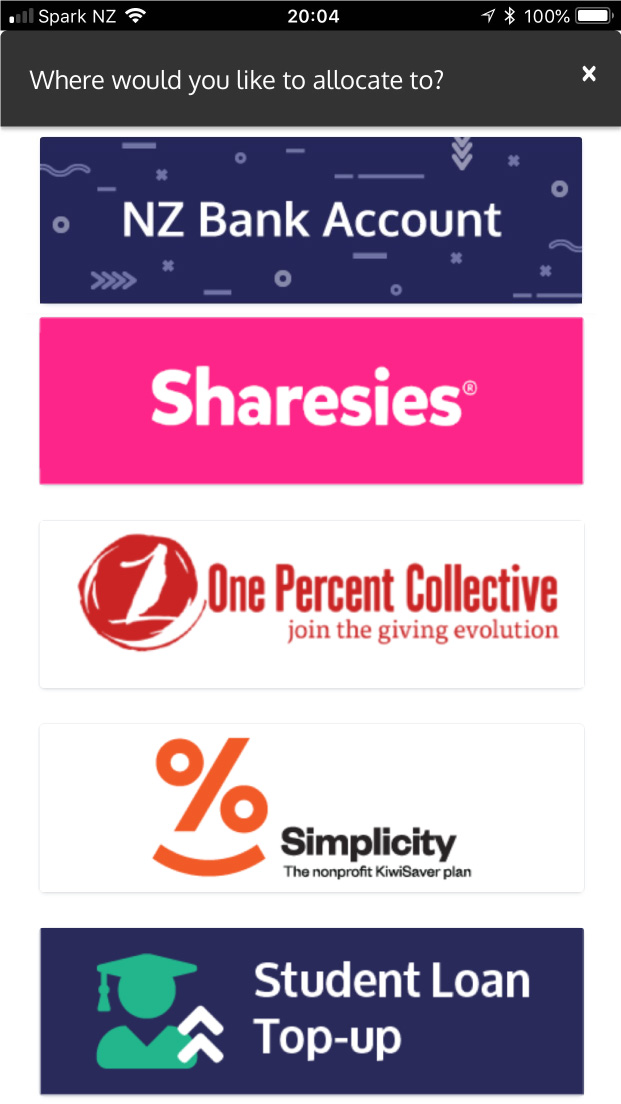

What that might look like:

- Sharing your Hnry Bank Account details directly with your client(s)

- Updating your payment details in the platform(s) you earn money through

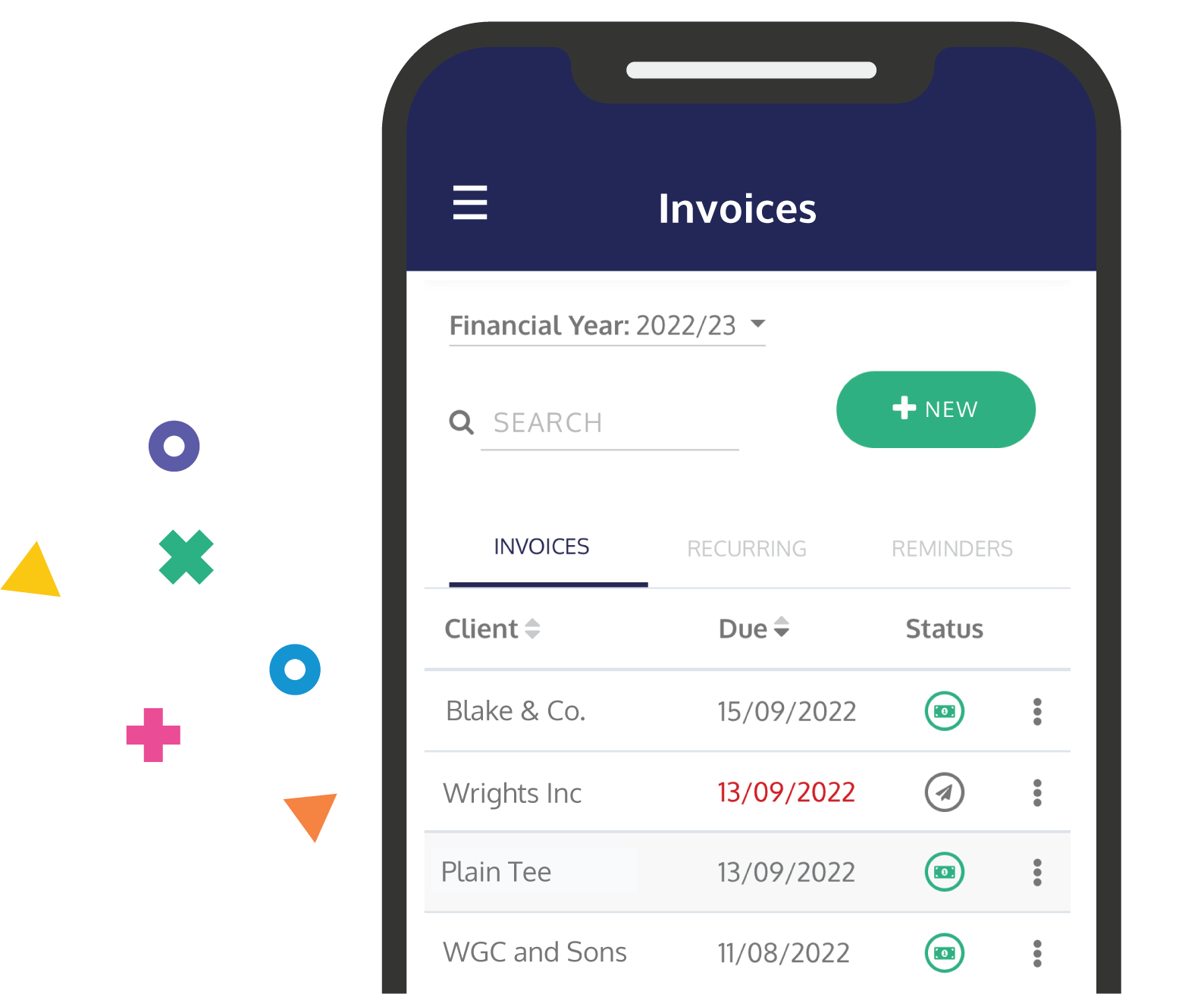

- Adding your Hnry Bank Account to invoices you send yourself (or send from another app)