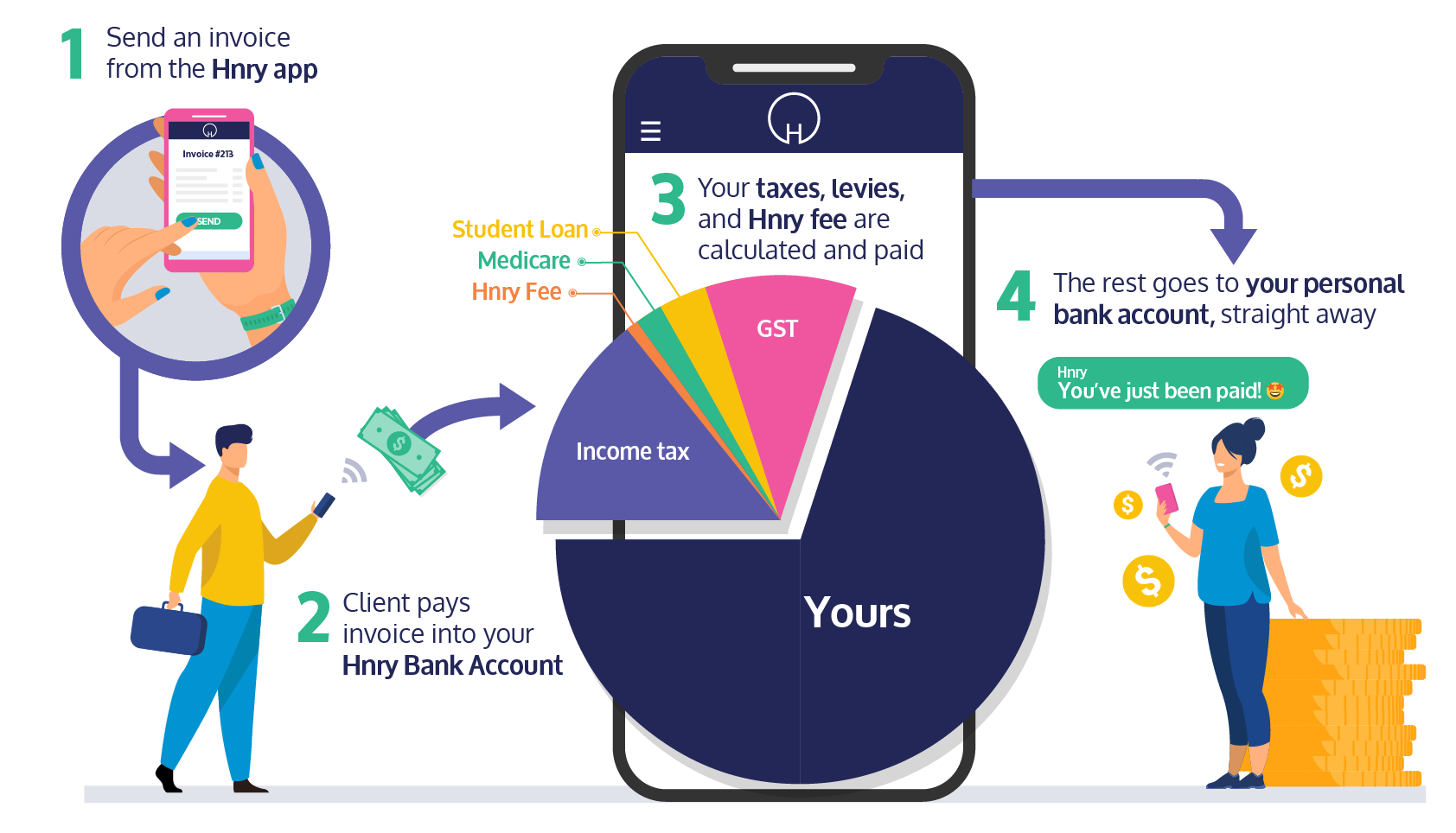

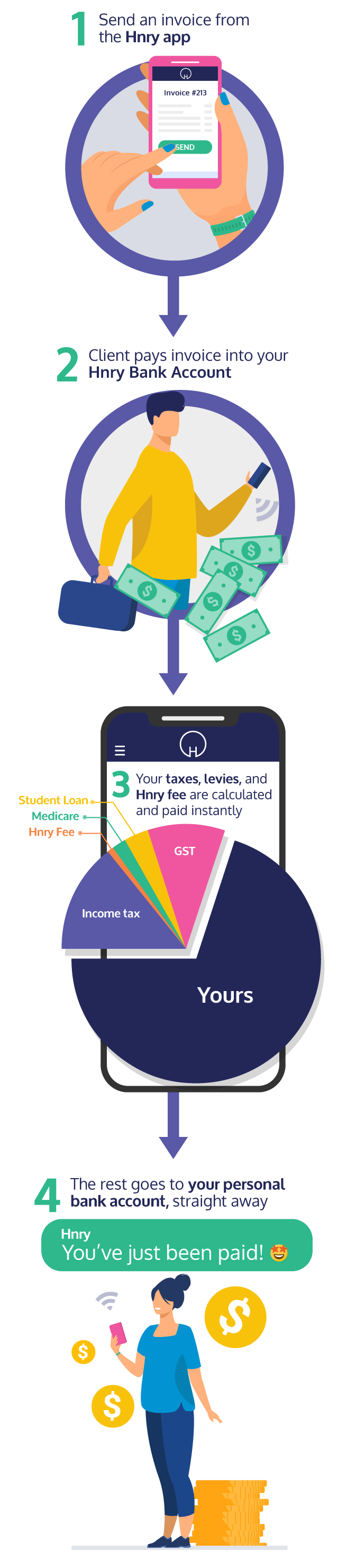

How it works

First, tell us how you will bill your clients?

First, tell us how you will bill your clients?

It’s easy (and free) to get started

No setup costs. No need to wait for the end of a tax year.

You can be up and running with Hnry in minutes - and never think about tax again!

Join Now

All your tax obligations - sorted!

" Hnry also lodges my income tax and BAS returns for me…I’ve got complete confidence that all my tax affairs are sorted - so I can focus on doing what I love. "

Tabitha Arthur

Freelance Photographer

Only pay when you’re earning

Here are 5 things you need to know about Hnry’s simple, pay-as-you-go pricing:

- You pay just $1+ GST from every $100 in self-employed income you earn

- Your fees get you UNLIMITED use of the entire Hnry service and our expert accounting team

- You only pay fees when your clients pay into your Hnry Bank Account

- For anyone earning over $150,000 in a financial year, Hnry’s 1% fee is capped at $1,500

- We automatically claim your Hnry fees for you as a business expense!

Our fee is

1%

of your self-employed income

*

*excludes GST. Fees capped at $1,500/yr

Minimum $0.50 fee per transaction.

Minimum $0.50 fee per transaction.