FAQs

Our system will fluctuate your tax rates up and down throughout the year (not a random fixed percentage like, say, 55%), based on how much you are earning and how much you’re claiming in tax deductions.

For this system to work correctly, it needs the right information from you, particularly about any earnings you’ve had prior to starting with Hnry.

You can view these payments by logging into your myGov account.

Note: Due to a delay on ATO’s side - these may take up to 30 days to appear in your account.

- File your income tax and GST returns whenever they’re due

- Review your expenses whenever you raise them, so you get tax relief as you go

- Give personalised answers to your gnarliest tax questions

How it works

02

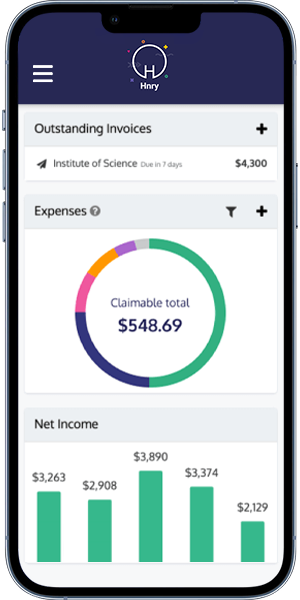

Whenever you get paid, we calculate, deduct and pay all your taxes straight away, taking into account your business expenses - before passing what’s yours on to you immediately

03

Relax! What you get paid is yours to keep. We’ll file all your tax returns for free whenever they’re due, and we’ll even chase down your overdue invoices if your clients are late paying

It’s always easy to switch to Hnry!

There’s no need to wait for the end of a tax year - we make it simple and seamless to make the switch to Hnry.

In minutes you can be up and running with Hnry - and finally get peace of mind on your obligations as a self-employed disability support worker

Only pay when you’re earning!

We charge a 1% +GST fee on income paid into your Hnry Bank Account.

For this, you get full access to the Hnry service, with no joining fees or subscription costs. We won’t charge you by the hour to answer your questions, review your expense receipts or file your tax returns - so you’re always paying a fair price, and only paying as you earn.

Here’s how our pricing works:

- You pay just $1+ GST from every $100 in self-employed income you earn.

- The Hnry’s 1% fee is capped at a maximum of $1,500 per year.

- If you receive individual payments of under $50, a minimum fee of $0.50 per payment applies.

- We automatically claim your Hnry fees for you as a business expense.