How it works

02

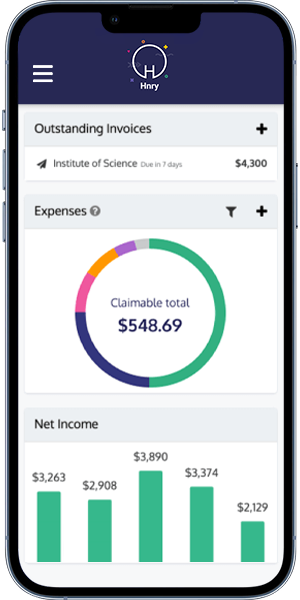

Whenever you get paid, we calculate, deduct and pay all your taxes straight away, taking into account your business expenses - before passing what’s yours on to you immediately

03

Relax! What you get paid is yours to keep. We’ll lodge all your tax returns for free whenever they’re due, and we’ll even chase down your overdue invoices if your clients are late paying

It’s always easy to switch to Hnry!

No matter what time of year, we make it easy to switch from your accountant, accounting software, or whatever else you use.

And, from the moment you switch to Hnry, you never have to think about tax again.

Hnry’s team of expert accountants ensures that ALL of your tax obligations (ATO, GST, & Medicare) are paid & lodged correctly.

Only pay when you’re earning!

We charge a 1% +GST fee on income paid into your Hnry Bank Account.

For this, you get full access to the Hnry service, with no joining fees or subscription costs. We won’t charge you by the hour to answer your questions, review your expense receipts or file your tax returns - so you’re always paying a fair price, and only paying as you earn.

Here’s how our pricing works:

- You pay just $1+ GST from every $100 in self-employed income you earn.

- The Hnry’s 1% fee is capped at a maximum of $1,500 per year.

- If you receive individual payments of under $50, a minimum fee of $0.50 per payment applies.

- We automatically claim your Hnry fees for you as a business expense.