The Goods and Services Tax (GST) is a consumption tax that’s charged on most goods and services in Australia. It’s called a consumption tax because it’s levied on things we “consume” (figuratively as well as literally), rather than being levied on our income.

If you’ve ever really studied a receipt, say from a large, green hardware store, you might have noticed an extra dollar amount on your receipt marked “GST”.

GST is 10% flat tax levied on top of whatever you paid for your paint roller/lawn flamingo/compound sliding mitre saw. But it’s not profit kept by the retailer – instead, it’s collected by them on behalf of the Australian Taxation Office (ATO). If you’re a sole trader, you may have wondered if you’re supposed to be charging GST too. And if so, how do you do it? Why do you do it? Do you have to raise your prices to cover it? What if your clients are based overseas?

All great questions. Luckily, we’ve got the answers. Let’s dig in.

- Introduction to GST

- Registering for GST

- Charging and Collecting GST

- Business Activity Statement

- Tl;dr: GST overview

1. Introduction to GST

What is GST?

Like we mentioned earlier, GST is a consumption tax levied on things we consume. We’re not just talking about food and drink here though; a consumption tax applies to most resources (goods and services) that can be used up, or “consumed”.

GST is also a flat tax, unlike income tax. This means that the GST tax rate – 10% – doesn’t change, no matter how much you earn, what you buy, or how much it costs. (Unless the product you’re selling is GST free – more on this later).

If you make $75,000 or more in business income, you’re required to register for and charge GST (see below). This means that you charge an additional 10% on top of your regular fees, which you record and pay to the government when you lodge your next Business Activity Statement (BAS).

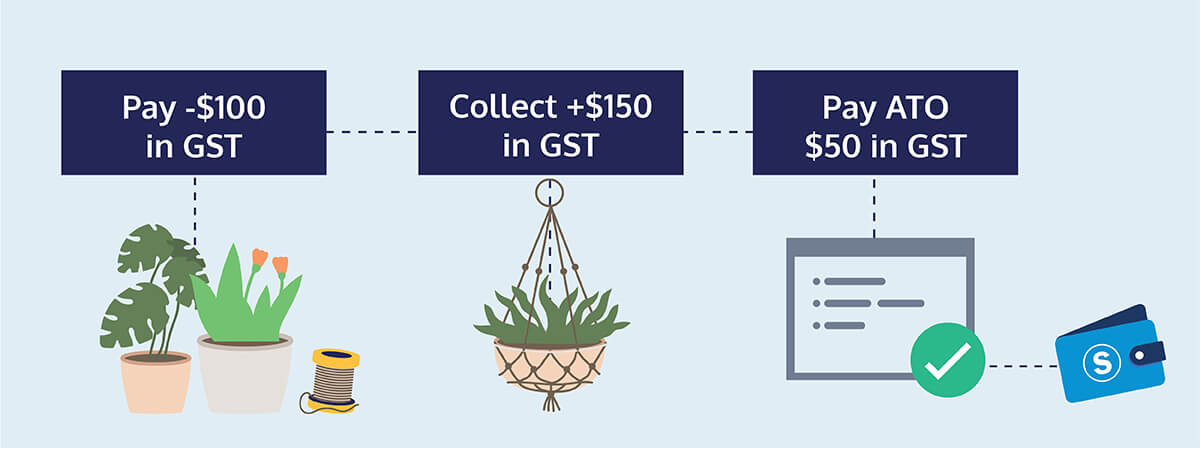

Whenever you buy goods and services for your business that have GST added, you can subtract the cost of the GST you’ve paid from the GST you need to pay the government. If you’ve paid more GST than you’ve collected, you may be eligible for a GST refund.

Not all products are subject to 10% GST. The Australian government exempts certain goods and services from GST, including residential housing, some kinds of food, certain healthcare services, some medications, and (weirdly) precious metal.

GST-free goods and services have a GST rate of 0% (see below). For more information, and for a full list of these goods and services, you can visit the ATO website.

Do I have to register for/charge GST?

Short answer

- If you’re registered for GST, you must charge and collect GST.

- Sole traders and businesses who estimate they’ll make $75,000 or more in business income in a 12-month period have to register for GST.

- Sole traders in certain industries, like limo and taxi drivers, have to register for GST regardless of income.

Long answer

If you make less than $75k in self-employed income

If you’ve made less than $75k in the last 12 months, you don’t have to register for GST. You can if you want to, but like with any business decision, there are pros and cons.

The main benefit of being GST registered is that you can claim GST back on your business expenses (subject to restrictions/exemptions). And if you pay more in GST when buying supplies for your business than you charge your clients, you are eligible for a GST refund.

If you’re below the threshold, you may decide that registering for GST isn’t worth it, as it can be a lot of extra paperwork for little reward. Ain’t nobody got time for that.

There are a few cases, however, in which you may consider registering for GST while you’re still under the threshold. If you buy a lot of supplies for your business in bulk, then being able to claim the GST back can help you better manage your cash flow. Similarly, it might make it easier to deal with your suppliers.

Whether or not you register for GST is up to you, but think of it as a calculated business decision. If you’re under the threshold, you need to decide if the benefits outweigh the cons.

Registering for GST: pros and cons

| Pros | Cons |

|---|---|

|

|

|

After five years of hustle, Graham has gained a bit of a reputation on the weekend market circuit. His wooden butcher blocks are the stuff of legend, and he’s created a steady side income that amounts to $15,000 in income a year.

Harry, meanwhile, accidentally went viral on Tik Tok after someone filmed one of his sets. His standup career has exploded, he’s making $85k a year in appearances, and he’s about to go on tour.

Harry realises that as he’s now making bank, he needs to be GST registered. He tells Graham, and Graham registers for GST as well, just in case.

Harry tacks on 10% GST to his usual appearance fees. He lodges BAS, and gets to claim the GST back on his microphone and equipment purchases.

Graham, however, has to add 10% on to his usual prices. He doesn't get to claim any GST relief as he sourcess all his wood for free from his parents’ farm, and already owns all the tools he needs to make his products.

Graham is well below the earning threshold for GST, and is not required to charge it. He doesn’t get much GST relief. It’s honestly more hassle than it’s worth.

As soon as he can, Graham cancels his GST registration.

If you make $75k+ in self-employed income

If you’re a sole trader, and you estimate you’ll earn $75k+ in a 12-month period in self-employed income, you are required to register for and charge GST on your goods and services. Yes, even if you aren’t registered as a company – neither are necessary for GST registration. (You will need an ABN to register for GST, though.)

If you’re an employee with a sole-trader side hustle, you only have to register for GST once you estimate your side-hustle income will reach $75k over the next 12 months. Your combined income doesn’t count towards the threshold.

It’s also important to note that the $75k threshold doesn’t apply to a single financial year, but rather any 12 months in succession.

For example, if you know you’ll make $75k between November of one year and October the next, you’re required to register for and start charging GST immediately – even though that 12 month period is split between two financial years.

Tl;dr: you need to register for GST as soon as your projected self-employed earnings for the next 12-month period reaches $75k. If you’re already making over the $75k threshold, you need to register for GST asap!

Jim, an architect for a big firm, brews in his garage on the weekend. He sells a few bottles to his mates as more of a social thing than a form of income, and makes less than $5,000 annually. Even though his combined income is over $60k that year, his sole trader income is not. He doesn’t have to register for GST.

Naveen is a stay-at-home dad, and enjoys brewing small batch, artisanal beer as a way to earn a little extra income. He makes $15,000 that year. Although his only income is his sole trader income, because it’s less than $75k a year, he doesn’t have to register for GST.

Antonio, however, is all in. He spends a few years building his brand “Lager Then Life”, and manages to get some of his products into local bottle shops. Business picks up, and he makes $85,000 in his fourth full year of trading.

Antonio’s sole trader income is now well over $75k. He definitely needs to be GST registered, and add GST to his prices asap.

GST-free products/services

In Australia, certain products and services are considered GST-free, meaning that you don’t have to charge for or pay GST on these – even if you’re over the $75k GST threshold and/or registered to pay GST.

You’ll still have to record a GST amount on your invoices – $0 – even though you aren’t charging your clients GST. And you’ll still be able to claim credits for the GST you pay on your business expenses.

Limited list of GST-free products/services

- Certain basic food items

- Some medical, health, and care services

- Some menstrual products

- Some medical aids and appliances

- Some medications

- Some childcare services

- Precious metals

This list is a good starting point, but it’s important to do your own research to make sure that you’re charging GST correctly. There are strict rules about specific items and services, so you shouldn’t make assumptions about whether or not yours fall within the GST-free category.

The ATO does provide a general list of GST-free goods and services you can refer to, but it’s not exhaustive. There’s also a search system available where you can look up specific products/services in case law.

Good luck!

2. Registering for GST

It’s a common misconception that registering as a sole trader, or lodging a self-employed tax return, or applying for an ABN automatically registers you for GST. This isn’t the case.

If you haven’t specifically registered for GST, you are not registered for GST. You won’t have to charge GST, and you can’t apply for GST refunds.

If you HAVE registered for GST, even if you aren’t required to, or you aren’t over the $75k threshold, you must collect and pay GST. The amount of GST you’ll need to pay is based on the income you receive during that GST period. You need to make sure that you collect GST from your clients. If you don’t, you’ll have to go back and ask your clients to retrospectively pay GST, or pay your GST bill out of pocket (!!!).

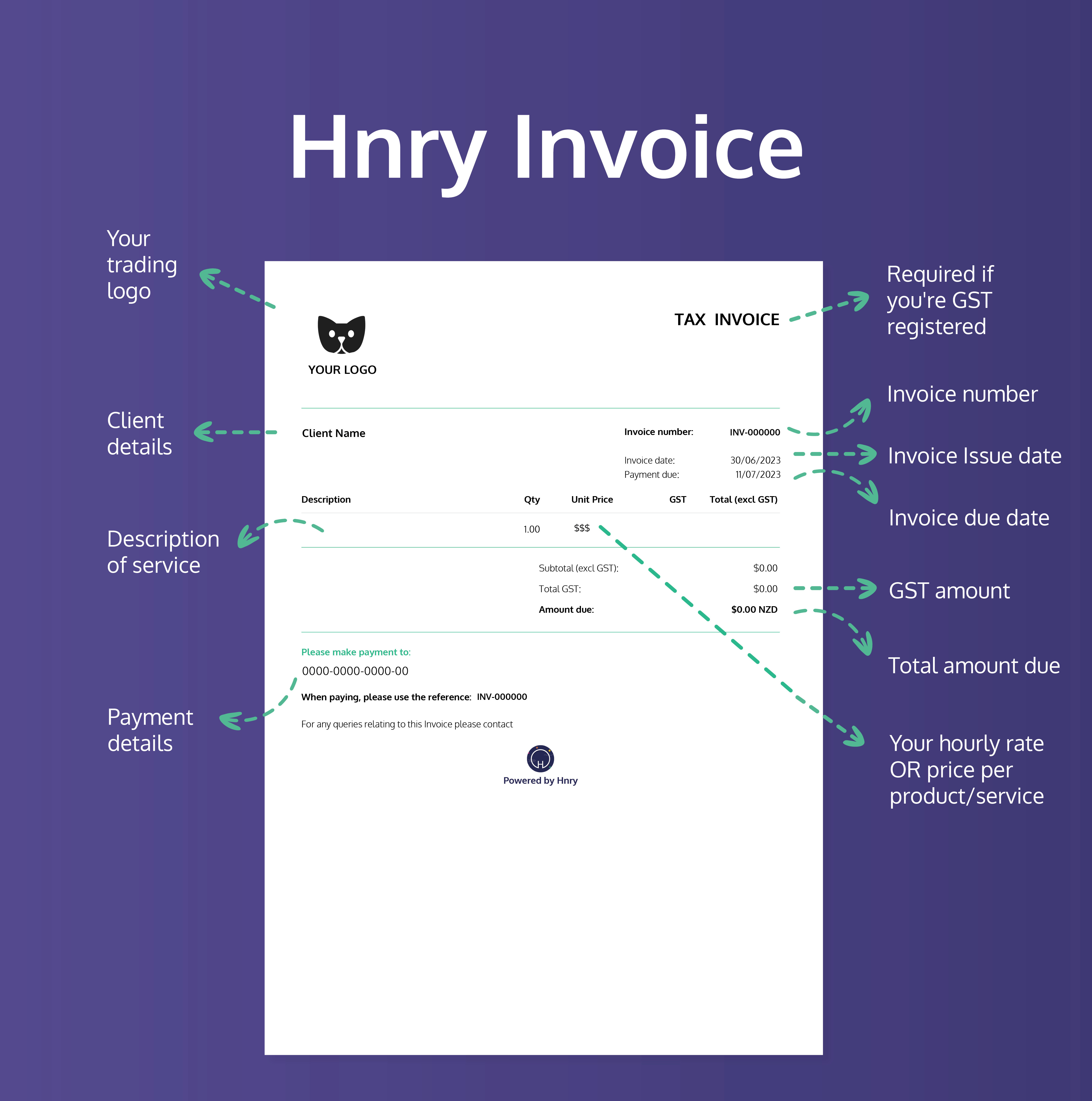

💡 If you’re GST registered, you’ll also have to create “tax invoices’’, which have to meet specific requirements. For more information, check out our ultimate guide to invoicing.

🙋 If you’re a Hnry user, we’ll let you know when you start approaching the $75k GST threshold. Plus, we’ll calculate and lodge all your Business Activity Statements (BAS) for you. See how it works!

Tl;dr

💡 Unless you’ve registered yourself for GST, you are not GST registered

💡 If you are GST registered, you must charge GST

💡 If you’re projected to make over $75k in any given 12-month period, you will need to register for GST

💡 You’ll need to collect GST once you’re GST registered.

GST Periods

When you register for GST, you decide how often you would like to lodge your BAS. This timeframe then becomes your GST period.

There are three options you can choose from:

- Monthly

- Easier to keep track of, but involves more paperwork

- Quarterly (every three months)

- Most common timeframe

- Annually (unless you earn over $75,000 a year)

- Harder to keep track of (if you don’t use Hnry), but less paperwork overall

You’ll also decide whether you’ll pay on a “cash” basis or an “accrual” (non-cash) basis (FYI at Hnry, we work on a cash basis).

Sometimes, you may find that within a GST period, you’ve paid more in GST than you have collected. In these instances, you would receive a GST refund from the ATO.

“Cash” vs. “accruals” basis

When you register for GST, you’ll also need to decide whether to register on a “cash” or “accrual” (non-cash) basis. Basically, will you pay GST when you’ve invoiced (accrual)? Or will you pay GST after you’ve received the payment of your invoice (cash)?

It’s an important choice, and will affect your business’ cash flow. Let’s break down the pros and cons.

Cash basis

When you register for GST on a cash basis, the date that you ‘recognise’ the GST on your sales will be the date that you receive the money.

For example, if you send someone an invoice on the 20th of March, and they pay you (including GST) on the 20th of April, you wouldn’t declare it in your BAS to the ATO until you’ve been paid – even if your GST period ends at the end of March.

Instead, you’d count it as part of the next GST period, at which point you’d send the GST to the ATO.

Accrual basis

When you register for GST on an invoice basis, the date that you “recognise” the GST on your sales will be the date on the invoice to your client.

Using the same example, you send an invoice on the 20th of March, and they pay it on the 20th of April. On an accruals basis, you’d have to declare the GST in the period the invoice was dated, and pay the GST to the ATO – even if you haven’t received the payment from your client yet.

There are some benefits to an invoice schedule – for example, you can claim GST you’ve received an invoice for, even if you haven’t paid it yet – but for sole traders, it can get stressful. Especially if your clients are notoriously late in paying their invoices.

There may also be more paperwork involved. Heads up.

Cancelling your GST registration

If your earnings drop below $75k in a 12 month period, or if you registered for GST while under the earnings threshold, and you decide that you no longer want to be GST registered, you may be able to cancel your GST registration.

The process is fairly straightforward. You can do it:

- Using online services for business

- Through your registered tax or BAS agent (like Hnry!)

- Over the phone by dialing 13 28 66 between 8am and 6pm Monday-Friday

- By posting a completed Application to cancel registration (NAT 2955) to the ATO

Simple! Done! Whoohoo!

3. Charging and Collecting GST

If you’ve decided to register for GST, the next step is to actually collect GST from your customers. This means adding an additional 10% to your prices.

It can be a bit nerve-wracking to suddenly “raise your prices” by 10%. But customers are used to paying GST, and should understand that they’re not paying you extra – they’re paying tax to the government.

Clients who are GST registered should be indifferent to you charging them GST, as they can claim it back in their own BAS. But if you’re worried about the price jump, you could preempt the change with a quick email to your regular clients.

You can also specify in your quotes whether or not your prices are GST inclusive or exclusive. The way you position it could make a real difference, depending on your customer base.

What we don’t recommend doing is absorbing the cost yourself – eg. not adding 10% GST to your prices, and paying your GST bill out of your own pocket. While the cost for your customers won’t change, you’ll effectively be taking a pay cut. And that will stack up over time in terms of revenue lost – especially if it means you have less left over to invest in your business.

Remember; GST is a tax levied on your customers, not you!

Calculating GST

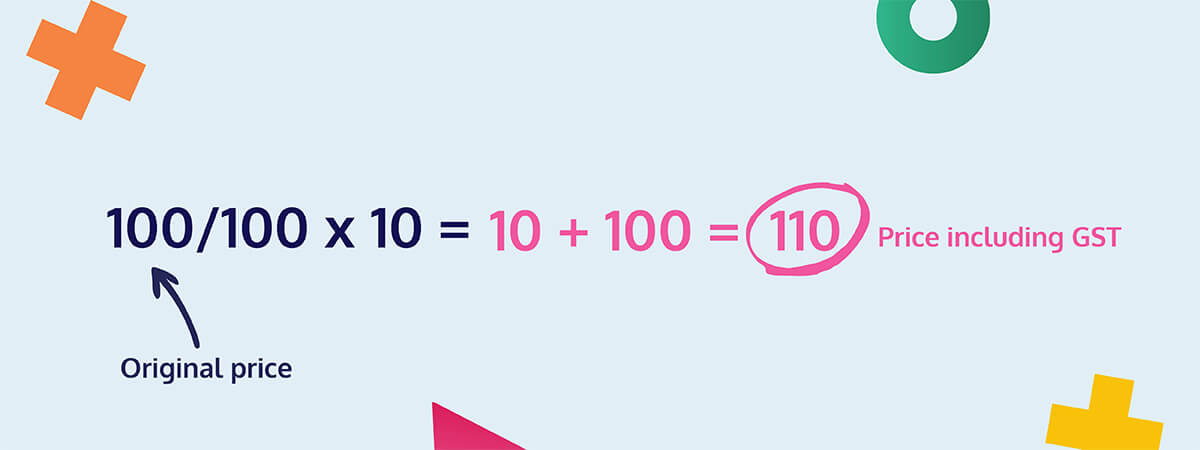

GST is a flat tax of 10% added to most goods and services sold by someone who is registered for GST. To add GST, you divide the original price by 10 and then add that number on to the original price:

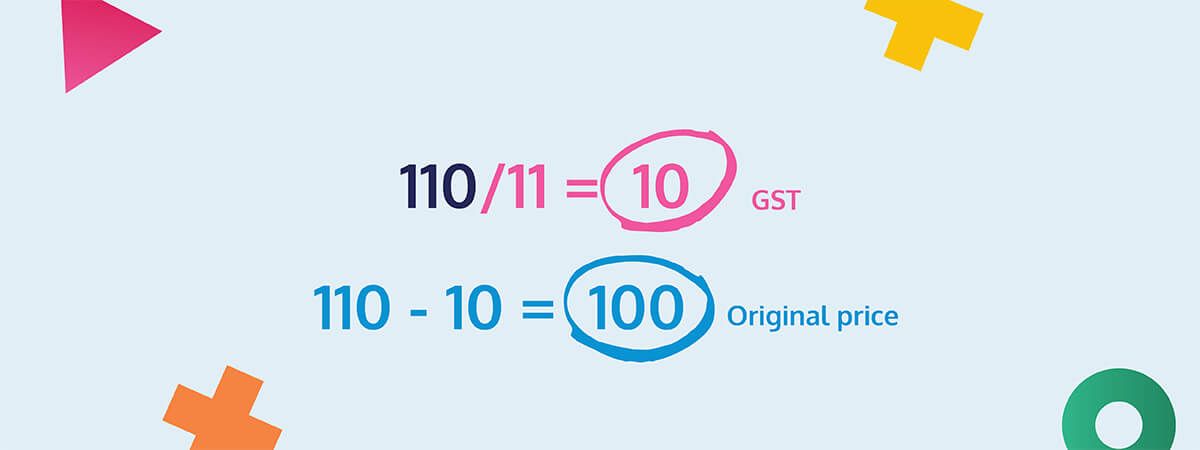

The equation to subtract GST is slightly more complicated. What you do is take the original price, divide that by 11 and then subtract that number from the original price:

GST inclusive vs. added GST

Whether a price is GST inclusive, or will then have GST added on, makes a real difference to the final cost.

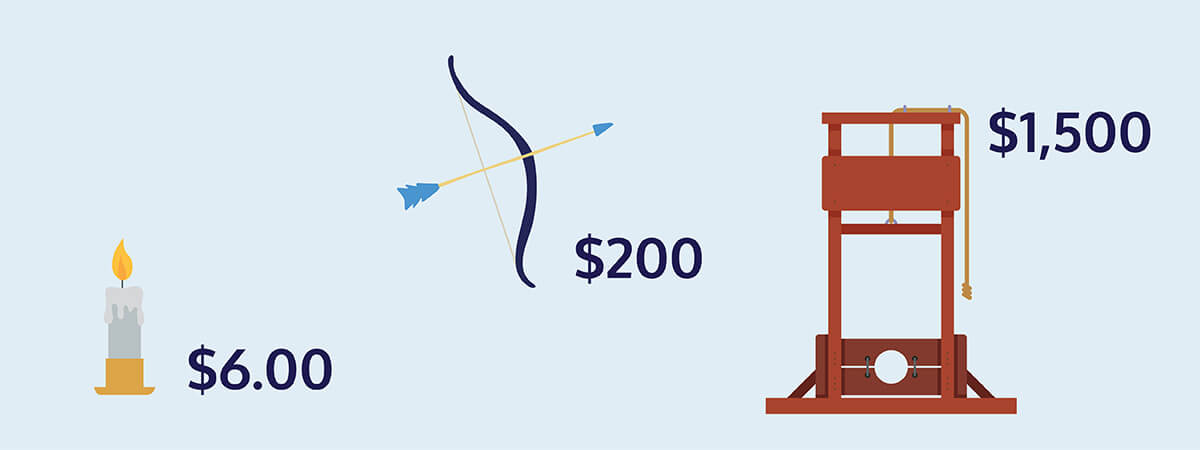

Say you go to a medieval fair and buy a beeswax candle for $6, a longbow for $200, and a life-sized, non-functional guillotine replica for $1,500. You know, to decorate your living room.

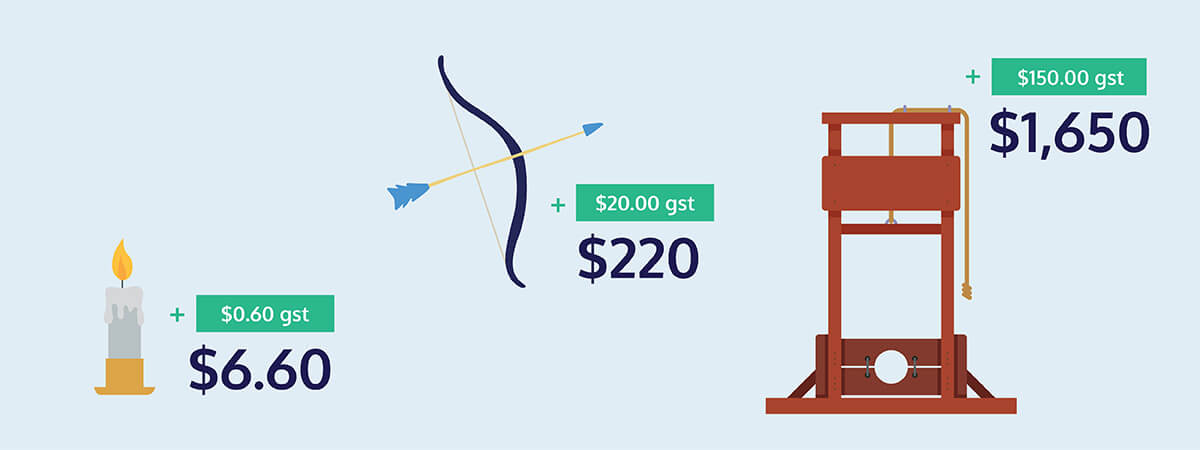

If the price of each item was already GST inclusive, it means that 10% of the original price has already been calculated and added to the final cost:

However, if each item still needed GST to be added on, the price would increase by 10%. What this means is that 10% of the original cost would be added to the final cost:

Moral of the story: Most vendors will let you know beforehand if they charge GST, but if you’re not sure, it’s worth it to check. You should also specify if your rates as a sole trader are GST inclusive or exclusive, just so there are no nasty surprises further down the track.

Also, you may want to ok a life-sized guillotine with your family before you bring it home and put it next to the TV. Just a thought.

GST Calculator

Recording GST on Invoices

If you’re GST registered, you’re required to provide “tax invoices”, which are slightly different from regular invoices.

You’ll need to provide a tax invoice if:

- the purchase is taxable

- the invoice is for more than $82.50 (including GST), or

- your customer asks for a tax invoice.

A tax invoice must include:

- The words “tax invoice” somewhere on your invoice (preferably up top)

- Your identity (business name or trading name, contact details)

- Your Australian Business Number (ABN)

- The date you issued the invoice

- A list of items/services sole, including quantity and price

- The GST amount payable – either listed for each item separately, or if the GST amount is exactly one-eleventh of the total price, through a sentence like “Total price includes GST”

- If your invoice is for $1,000 or more (including GST), you also need to include your customer’s business name or ABN.

📖 For more information on creating invoices, check out our guide to invoicing like a pro

FYI, Hnry users don’t need to worry about being compliant with ATO invoicing rules. Invoices sent through our app will still include all the information required, whether or not you’re GST registered, so you’re covered no matter what.

We’ll also claim back GST for our users when we lodge their BAS, so they can get on with the fun stuff.

Charging/Paying GST overseas

Charging GST overseas

Whether or not you need to charge GST when selling your stuff overseas depends on whether or not your client exists in Australia.

By that we mean whether or not they operate in, or have any trading presence in Australia. We’re not trying to spark an existential crisis.

If your client operates outside of Australia, with no local presence, you generally charge them GST at a rate of 0% (this is referred to as being “GST-free”).

So if you sell products or services to an overseas client, you still need to record GST of $0.00 in your invoice. You’d include these sales in your regular BAS’s. And you’re still eligible to claim back any GST you’ve paid for business expenses.

One of her clients is a videogame retail company called “Cyclone Games”, who solely operate in New Zealand. She writes reviews of the latest video game releases, which they then publish on their website.

Because Maria lives and works in Australia, and Cyclone Games has no Australian presence, the service she provides them is GST-free for GST purposes. She charges them GST at 0%, and is still able to claim the GST back for her business expenses.

In a year or two, Cyclone Games plan to expand their business to Australia, making their games available for online purchase for Aussies. When they do this, Maria will no longer be able to GST-free the services she provides to them, and will have to charge them GST at 10%.

💡Even if the product you’re supplying your client is GST-free, you still have to note the $0 of GST that was “charged”. This means that your client pays nothing in GST, but you still have to record these sales in your regular BAS lodgements. Yep, we know it’s weird and confusing – it’s just one of those things.

Paying GST overseas

Whether or not you pay GST on overseas purchases depends on who you’re buying from.

Typically, it’s your supplier’s responsibility to figure out if they need to charge Australian GST on the products/services they sell you.

You can only claim GST credits if there’s Australian GST charged on an invoice.

If your supplier is required to charge you GST or sales tax for another country, you can’t claim a GST credit on it. Only Australian GST can be claimed for Australia-based businesses.

4. BAS Lodgements

What is a BAS?

When you’re GST-registered, you are required to lodge a Business Activity Statements (BAS) on a regular basis.

A BAS is essentially a declaration to the ATO of:

- the total GST you’ve collected on your sales/income; and

- the total GST you’ve paid while making business purchases.

What you then pay to the ATO is the balance between the two figures:

In the last two months, she’s paid $200 in GST on craft supplies, and collected $300 in GST from product sales.

Instead of paying the full $300 collected to the ATO, Sarah subtracts the $200 GST she’s paid from the total she’s collected. She pays the ATO $100, and keeps the rest.

💡 Hold any GST you collect separately from the rest of your income. That way, you’ll always have the right amount on hand to send to the ATO. If not, you’ll be hit with fines and penalties. If you’re a Hnry customer, we do this on your behalf!

Whenever a GST period is complete, you’ll need to fill out a BAS. It can get slightly complicated, but the ATO walks you through the process on their website.

When are BAS due?

Generally, monthly BAS are due for lodgement and payment on the 21st day of the month after the GST period ends. If you’re on the more common quarterly BAS schedule, your BAS are due to be lodged and paid on the 28th day of the month after the GST period ends.

For example, if you lodge 3-monthly and your GST period is from the 1st of January to the 31st of March, your BAS will be due on the 28th of April.

It’s a good idea to make a note of your BAS due dates and note them in your calendar. If you lodge late, you may end up with fines and penalties.

Alternatively, you could use Hnry. For just 1% of your self-employed income (capped at $1,500 a year), Hnry will calculate, pay, and lodge all your taxes for you. This includes lodging ALL YOUR BAS. Whoohoo!

5. Tl;dr: GST Overview

Ok, we know that that’s a lot of information. To help it all stick, here are the quick takeaways:

- GST is a flat-rate tax of 10% levied on certain goods and services.

- If you’re a sole trader, and your income is below $75,000 in a 12-month period, registering for GST is optional.

- If you haven’t registered for GST, you’re not registered for GST. It’s not an automatic thing.

- You can be registered for GST as an individual sole trader – you don’t need to register a company.

- You can’t charge GST unless you’re registered for GST. If you’re registered for GST, you should always include GST in the price of your sale (or get caught out by the ATO).

- If you register for GST partway through the year, you start charging GST from then on – you don’t have to back pay.

- BAS are lodged on a monthly, quarterly or annual basis.

Hnry will do it all for you. No, seriously.

You can read a 4,000-word article on GST – or you can let us do it all for you instead.

(If you’ve made it this far though, we’re seriously impressed. Nerd.)

For just 1% of your self-employed income, capped at $1,500 a year, Hnry will calculate and pay all your taxes, levies and whatnot for you, including:

- Income tax

- GST

- Medicare Levy

- Student loan repayments

- Super contributions

We also lodge your income tax and BAS for you, at no added cost. AND we handle all your financial admin, like:

- claiming expenses,

- sending quotes and invoices,

- and chasing up late-paying customers (politely of course.)

Basically, you don’t have to go at it alone anymore. Hnry was designed by sole traders, for sole traders. We know exactly what you need to get the job done.

Join Hnry today!

Share on: