How it works...

First, tell us how you will bill your clients?

FAQs

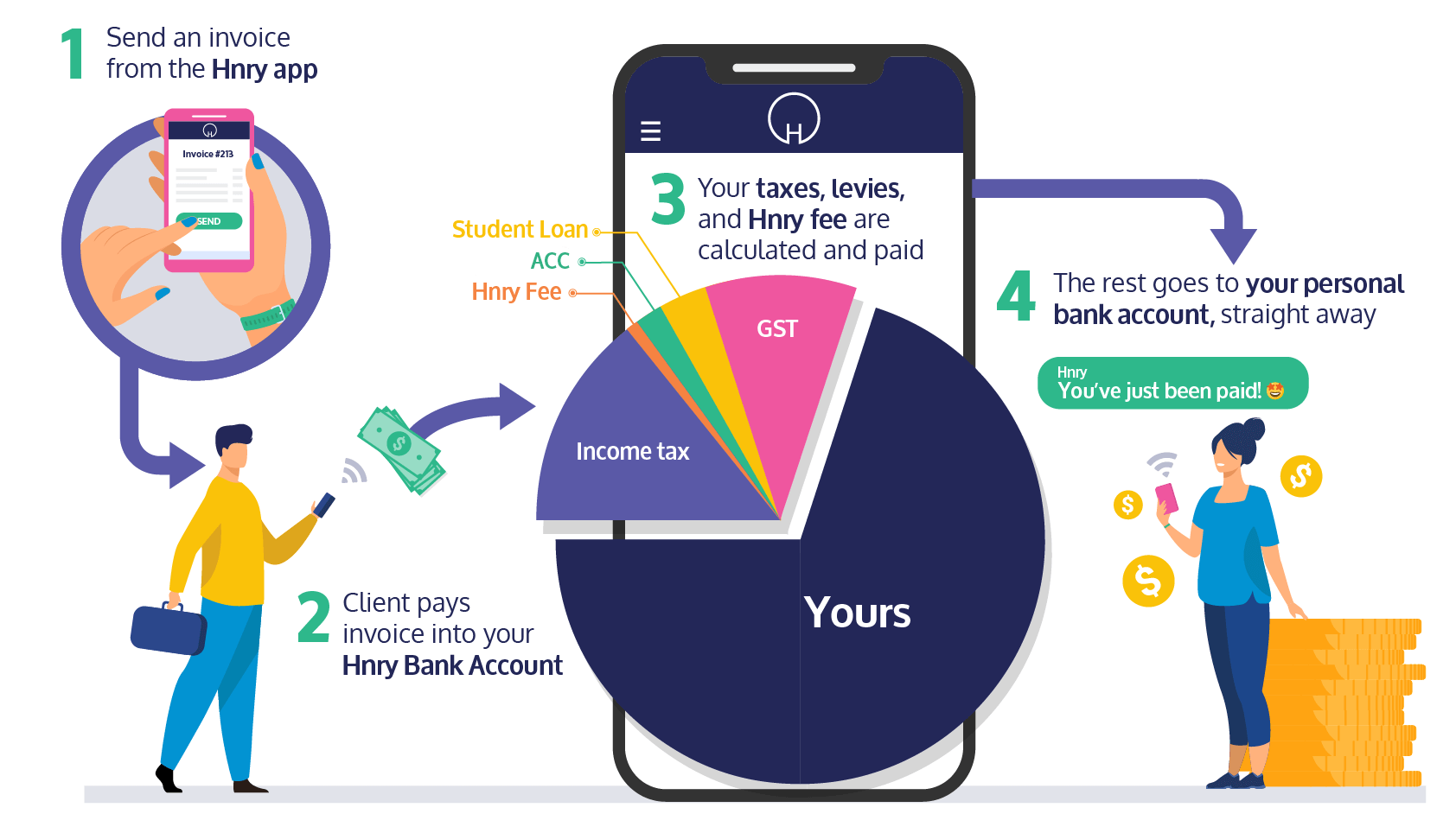

Hnry is designed to ensure you’re up-to-date on your taxes so that you never get a big tax bill at the end of the year.

Our system will fluctuate your tax rates up and down throughout the year (not a random fixed percentage like, say, 55%), based on how much you are earning and how much you’re claiming in tax deductions.

For this system to work correctly, it needs the right information from you, particularly about any earnings you’ve had prior to starting with Hnry.

Our system will fluctuate your tax rates up and down throughout the year (not a random fixed percentage like, say, 55%), based on how much you are earning and how much you’re claiming in tax deductions.

For this system to work correctly, it needs the right information from you, particularly about any earnings you’ve had prior to starting with Hnry.

No. We pay it straight away, every time you get paid. As soon as your payment arrives into your Hnry Bank Account, we calculate, deduct and pay your taxes straight to the IRD.

You can view these payments by logging into your myGov account.

You can view these payments by logging into your myGov account.

No, using Hnry to invoice is completely optional.

Using the Hnry app to invoice your clients is quick and easy, but if you prefer different invoicing software, or don’t invoice at all, that’s totally fine - just make sure you’ve got your Hnry Bank Account number linked to your payment services and on your invoices. You choose how you want to run your business!

Using the Hnry app to invoice your clients is quick and easy, but if you prefer different invoicing software, or don’t invoice at all, that’s totally fine - just make sure you’ve got your Hnry Bank Account number linked to your payment services and on your invoices. You choose how you want to run your business!

Your taxes filed by expert accountants

As part of the Hnry service, our expert team of accountants also file any tax returns on your behalf - whenever they’re due.

Our team are always on hand to answer your questions and usually respond within minutes. Once you start using Hnry, you’ll have complete confidence that your taxes are paid and filed correctly - by an entire team of accountants!