Hnry for real estate agents

For full functionality of this site it is necessary to enable JavaScript in your web browser. Click the button below for instructions on how to enable JavaScript, then refresh the page.

InstructionsYou'll need to upgrade to a modern web browser to access this site. Click below to see some options.

View Browsers

Hnry's Expert Services team can handle even the most complex tax scenarios. We can help you manage:

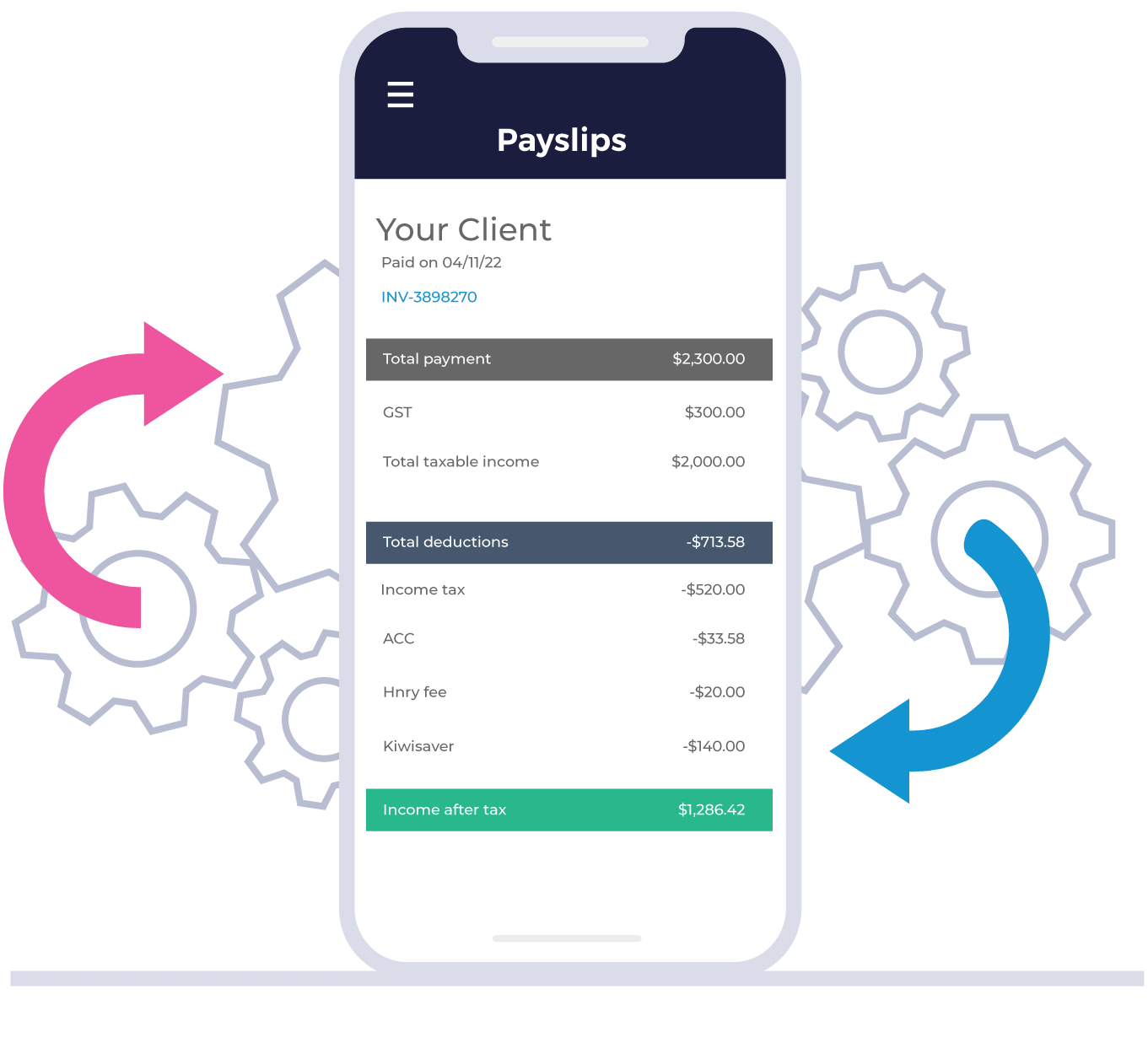

We charge a 1% +GST fee on income paid into your Hnry Bank Account.

For this, you get full access to the Hnry service, with no joining fees or subscription costs. We won’t charge you by the hour to answer your questions, review your expense receipts or file your tax returns - so you’re always paying a fair price, and only paying as you earn.

Here’s how our pricing works: