Did you know that October is Financial Planning Month…? We didn’t either, but apparently it is a real thing. It makes sense: the days are longer and the flowers have blossomed. You’ve already cleaned up your home so why not clean up your financial situation as well? Springtime seems as good a time as any to think about how you manage your finances.

To prepare for October, we talked to a lot of self-employed people about how they manage their finances. We know that everyone handles their money differently, getting insights from all sorts of sources, so we were interested to hear about all of the behaviours out there. We sent out surveys, called up customers and took some time to get to know our people. We’ll be releasing more of this data over the coming weeks but for starters, here are a few insights into the wide swath of people who consider themselves self-employed:

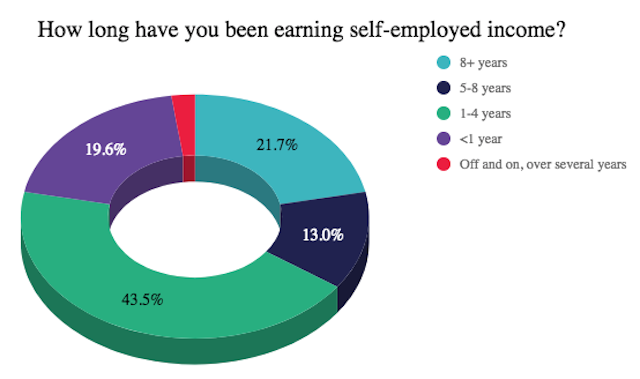

The majority (roughly 44%) of self-employed people we asked have been earning self-employed income for between one and four years. Moreover, we found that there was a fairly even split between people who had earned self-employed income for longer than eight years and those that have been earning for less than one. It’s safe to say that self-employment affects a great number of people, all of whom find themselves in various socioeconomic groups.

We’ve also seen, to quite a unanimous extent, that money really does make the world go round. It goes without saying then that financial goals, those dreams we have for our money, act as important drivers for people. Whether you’re self-employed or make a living at a permanent job, we all want to feel like our money is empowering us to build for good futures through those financial goals we’ve put in place for ourselves.

From the self-employed people we asked, the most common financial goals people had were:

- Investing in stocks & funds

- Paying off debts

- Saving for retirement

In other words, the same financial goals are found across social groups, no matter how you earn your income. So it surprised us that, of the self-employed people we asked, one-third did not feel they could achieve their financial goals in the next five years.

Why do self-employed feel they can’t hit their financial goals? A large barrier for people wanting to enter self-employment is the loss of financial “security” that a traditional nine-to-five offers. We’ve talked before about how the self-employed can get started on their path towards career autonomy, and offered some financial advice for the self-employed – but the financial barriers can still be very difficult to navigate.

The question then becomes, “where do you allocate your money?” We know that people want to plan for their future via a set of financial goals. But keeping a detailed plan of where you’re putting your money each month is easier said than done, especially if you have a time of the month that’s particularly money-tight, when rent is due and bills have to be paid, and yet you haven’t been paid yourself. Things like investing in stocks and funds and your KiwiSaver account, or trying to pay off debts, they all become even more difficult to manage if you’re feeling that “crunch time” each month.

If you haven’t seen it yet, we recently launched our new sister site, The Leap, where we provide community, content and support specifically for the self-employed. This month we decided to theme The Leap around financial empowerment for the self-employed: from allocating money for long-term investments like mortgage payments, stocks, and superannuation funds, to charitable giving and family support.

Here at Hnry, we want to financially empower you in any way we know how. Not only do we handle taxes and compliance for the self-employed, hassle-free, but we’ve also paired up with some great Kiwi companies that can help give you extra financial support. So this “Financial Planning Month”, we’ll be bringing you stories of people who manage their money well, as well as tips and advice from companies we consider helpful friends – and it’ll all be housed on The Leap!

Stay tuned – this month is sure to give your money a good pair of wings 💸

If you have any stories or advice about how you manage your finances, we’d love to hear from you!

Share on: