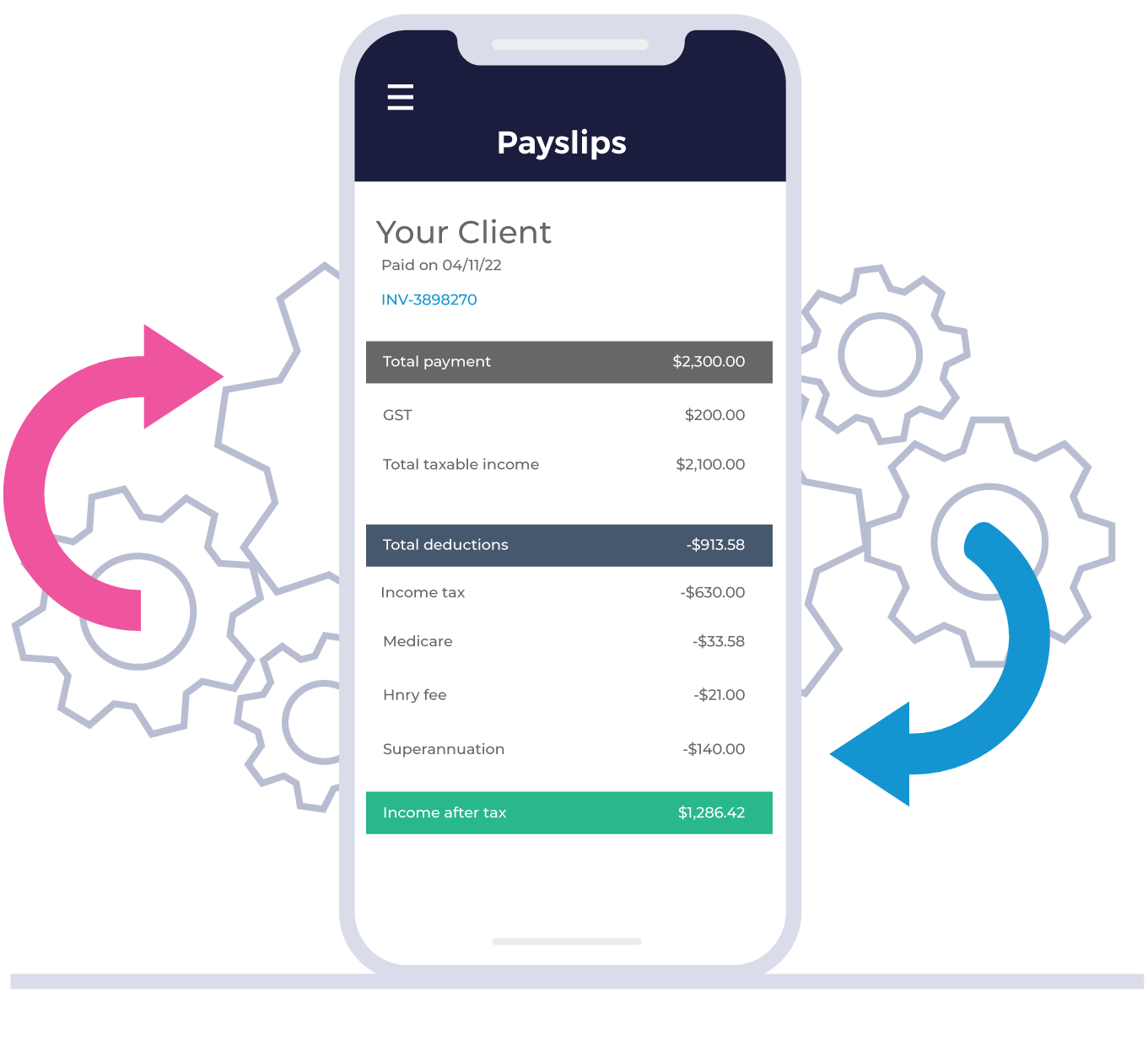

1. Automatic tax calculations and payments

Whenever you get paid into your Hnry Bank Account, we will instantly calculate and pay your:

- Income tax

- GST

- Medicare

- Student loan

3. We become your accountant

Our team of (real human) accountants will:

- Lodge your income tax and BAS returns whenever they’re due

- Review your expenses whenever you raise them, so you get tax relief as you go

- Give personalised answers to your gnarliest tax questions

FAQs

Our system will fluctuate your tax rates up and down throughout the year (not a random fixed percentage like, say, 55%), based on how much you are earning and how much you’re claiming in tax deductions.

For this system to work correctly, it needs the right information from you, particularly about any earnings you’ve had prior to starting with Hnry.

You can view these payments by logging into your ATO account via your myGov account.

Using the Hnry app to invoice your clients is quick and easy, but if you prefer different invoicing software, or don’t invoice at all, that’s totally fine - just make sure you’ve got your Hnry Bank Account number linked to your payment services and on your invoices. You choose how you want to run your business!

All your financial admin. Done.

We automatically pay and lodge taxes, provide a service for admin management, and become your accountant. In short – we get it done, so sole traders never have to think about tax again.

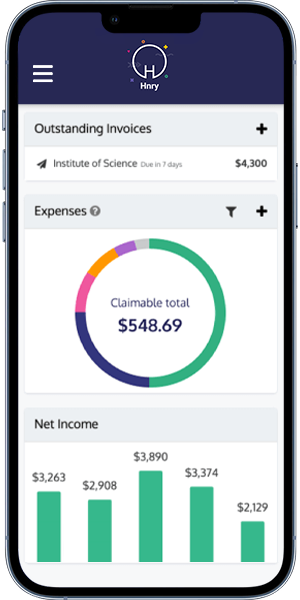

Tax payments

All your taxes (income tax, GST, Medicare) automatically calculated and paid as you go.Learn more >

Tax returns lodged

As part of the service, our accountants will lodge all of your returns whenever they’re due.Learn more >

Raise expenses

Raise expenses easily - our team of expert accountants will review them in real time.Learn more >

Invoice clients

Easily send unlimited invoices in minutes - we'll even chase your late-paying clients.Learn more >

Allocate your savings

Send earnings to savings, Super, and investments accounts whenever you get paid.Learn more >

Quick payment options

Accept a range of payment options - even credit card payments at no extra cost to you.Learn more >

Want to get up and running with Hnry?

It’s super easy to get started and only takes a few minutes!

Need a little extra help? Check out our handy guide to get you set up and running in just three simple steps.

Only pay when you’re earning!

We charge a 1% +GST fee on income paid into your Hnry Bank Account.

For this, you get full access to the Hnry service, with no joining fees or subscription costs. We won’t charge you by the hour to answer your questions, review your expense receipts or lodge your tax returns - so you’re always paying a fair price, and only paying as you earn.

Here’s how our pricing works:

- You pay just $1+ GST from every $100 in self-employed income you earn.

- The Hnry’s 1% fee is capped at a maximum of $1,500 per year.

- If you receive individual payments of under $50, a minimum fee of $0.50 per payment applies.

- We automatically claim your Hnry fees for you as a business expense.